Which Is the Better Alternative Lender for Your Business?

As a borrower and a small business owner getting to know the world of online financing options and alternative lenders is important as technology advances and traditional banks offer less flexibility. Not everyone has spent time analyzing Fundbox, BlueVine or OnDeck. They are among some of the best lenders to work with offering a timely and responsive access to capital when you need it.

But working with online alternative lenders presents a great opportunity for business owners to obtain financing quickly, affordably, and under realistic qualification standards—something that for more than a decade now has been all but impossible through a traditional bank.

Without the opportunity to meet with these new lenders face to face, how do you know which online alternative lender to trust with your small business loan?

Our borrowers can attest that each of these lenders are fantastic companies to do business with. However, each offer very different loan products for different kinds of customers, so the best choice for you depends on your business’s unique needs and financial situation.

We take a look at each of these lenders and the loan products they offer to help you evaluate each lender and identify the best choice for your small business loan.

All About Fundbox

Fundbox is a financial technology company that provides invoice financing and revolving lines of credit for small business owners.

Before we go any further, here’s an at-a-glance look at Fundbox’s credit line amounts and terms:

- Loan Amount: $100-$100,000

- Loan Term: 12 or 24 weeks

- Loan Rates: Approximately 0.5% to 0.9% of the drawn amount per week

Sound like a potential fit? Here’s what you need to know about working with Fundbox for your small business loan.

Best for: Companies Who Regularly Invoice Customers or Want a Flexible Credit Line

Fundbox

finances B2B businesses that have unpaid invoices or need access to a

short-term line of credit. If you invoice customers and are currently

facing a cash flow challenge as you await payment on invoices, Fundbox’s invoice financing product could be your perfect fit. They offer one of the

simplest, fastest underwriting processes of any lender, and they will advance

you 100% of the value of your outstanding invoices.

From there, you’ll pay back the loan over 12 weeks or 24 weeks with

automatically withdrawn weekly payments and predictable fees. Fundbox doesn’t

directly collect funds from your customers, so you maintain total control of

your customer experience. And if your customers happen to pay their invoices

ahead of schedule, you can pay off your loan early with no prepayment fee.

Even if you don’t invoice customers, you can apply for a revolving business line of credit from Fundbox that you pay back over 12 or 24 weeks. You only pay a fee on the amounts you draw, and when you pay back what you owe, that amount becomes available to you again.

How Fundbox Works

In order to obtain funding from Fundbox, you’ll be asked to connect your accounting software or business bank account directly to their system, granting Fundbox access to detailed analytics about your sales history.

Once your financing has been approved, this connection will also give Fundbox access to timely updates as your customers issue their payments.

Fundbox’s system is readily engineered to work with cloud-based accounting systems including, but not limited to:

- QuickBooks Online

- QuickBooks Desktop

- Freshbooks

- Harvest

- Wave

- Xero

- SageOne

- InvoiceASAP

- Clio

- Jobber

- Zoho

- Kashoo

And more!

5 Steps to Funding Through Fundbox

- Create a free Fundbox account.

- Connect your accounting software or business bank account.

- Choose eligible invoices to finance, or select your desired credit line

- Once you’re approved, you can draw from your credit line. Funds will be available the next business day.

- Each Wednesday for 12 weeks or 24 weeks, your account will be debited for payment.

Once you’ve been approved for initial financing, you’ll be able to keep your accounting software or bank account connected to Fundbox and draw from your available credit at any time.

Fundbox’s Eligibility Requirements

The standards to qualify for a loan from Fundbox are relatively easy. Here’s a quick glance at the average requirements you’ll need to meet:

- Minimum Time-in-Business: Two months

- Profitability: No

- Collateral: No (Fundbox might place a lien on business assets in some cases)

- Personal Guarantee?: No on lower credit limits

- Annual Revenue: $50,000

- Entity Type: Any U.S. based business

When Fundbox Isn’t a Good Fit

Although

Fundbox has few restrictions in terms of your credit history or your business’s

financial qualifications, this lending solution certainly isn’t the right

solution for every business.

Fundbox won’t be a good fit for your business if you:

- Won’t be able to repay a loan within 12 to 24 weeks

- Need more than $100,000 in financing

BlueVine: The details

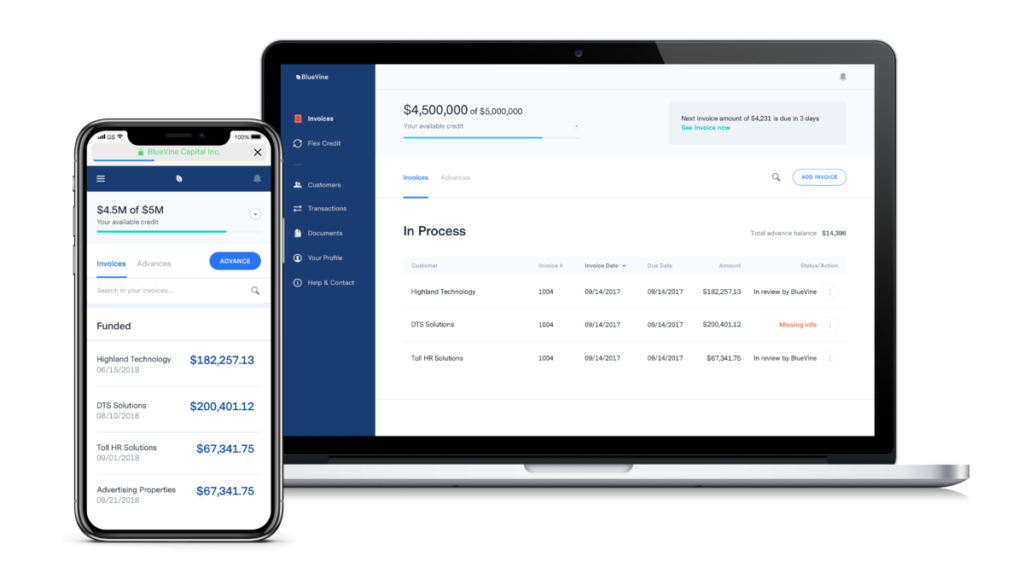

Based in Redwood City, California, the online lender was founded in 2013. BlueVine has delivered about $2 billion to more than 15,000 small business owners, according to its website. It’s backed by private investors, including Menlo Ventures, SVB Capital, Lightspeed Venture Partners and others.

They offer three loan products. A line of credit, term loans and invoice factoring.

Line of credit

BlueVine offers lines of credit from $5,000 to $250,000 for eligible borrowers. Opening a line of credit would allow you to borrow the exact amount of money you need as soon you need as you need it. BlueVine doesn’t charge fees to open or maintain a credit line, or prepayment or account closure fees. Interest rates start at 4.8% and you would only pay interest on what you draw from your credit line. As you make payments, the full line would become available again.

To be eligible for a line of credit, business owners need:

- FICO score of at least 600

- Six months in business

- $100,000 in annual revenue

- Three months of recent bank statements, or you’ll need to provide access to your bank account

You could be approved in as little as 10 minutes. Funds could be deposited in your bank account in up to three business days, or even as soon as a few hours. Each withdrawal you make from your line of credit would need to be paid back through fixed weekly or monthly payments on a six- or 12-month schedule. BlueVine would automatically debit payments from your bank account.

Term loan

BlueVine’s term loans are also available up to $250,000, with interest rates as low as 4.8% and the same eligibility requirements and time to funding as lines of credit. You would receive your term loan in full as a one-time deposit. To collect payments on term loans, BlueVine would make automatic weekly withdrawals from your bank account.

Invoice factoring

Invoice factoring is available from BlueVine as well and would allow you to get an advance on outstanding invoices. Invoice factoring isn’t technically a loan; rather, BlueVine would purchase your invoices in exchange for immediate cash.

BlueVine offers up to $5 million through invoice factoring and could approve applicants in as little as 24 hours. BlueVine can provide 85% to 90% of your invoice value upfront. When invoices are paid, you would receive the remaining amount, minus a fee that could be as low as 0.25%.

To be eligible for invoice factoring, BlueVine requires:

- FICO score of at least 530

- At least three months in business

- $100,000 in annual revenue

- Three months of recent bank statements or access to your bank account

Your company must also be business-to-business to qualify for invoice factoring from BlueVine.

OnDeck Capital

Founded in 2007, OnDeck Capital is a pioneer in the alternative lending industry. The company prides itself on providing large amounts of capital, fast approval and rapid funding. Since launching, OnDeck has provided over $2 billion in financing to companies in more than 700 industries. (There are a few industries it won’t finance; see what those are here.)

OnDeck provides two types of financing:

- Line of credit. Lines of credit are available for up to $20,000. On the Fundera platform specifically, Trihawk Capital customers borrowed a median of $17,000. OnDeck’s lines of credit fund within 45 days, but Trihawk Capitals customers experienced an average of 6 days to funding. In order to get a line of credit, you must have a minimum personal credit score of 600, have been in business at least one year and have minimum annual revenues of $200,000. Fixed weekly payments are automatically deducted from your business bank account, along with a $20 monthly fee. Once money is drawn from the credit line, it must be repaid within six months.

- Short-term loans. Loan sizes range from $5,000-$250,000. The median size loan Trihawk Capital customers have obtained is $80,000. Funding occurs within 30 days, but can be as fast as 24 hours. The median time to funding for Trihawk Capital customers was 4.5 days. Short-term loans are repaid within three to 24 months via either daily or weekly repayments, depending on the loan amount. The minimum personal credit score required is 500; you must have minimum annual revenues of $100,000 and have been in business for at least 12 months.

It takes under 10 minutes to complete OnDeck’s one-page, online loan application. All the documentation you need is the past three months’ worth of business bank statements and credit card statements, as well as your Social Security number and/or employer identification number (EIN)

In Summary….

Most businesses will find themselves in need of a loan at some point—and it can be difficult to decide where to turn for that funding. Fortunately, Fundbox, Bluevine and OnDeck can be a great option for business owners. Now that you understand what each of them can offer for small business owners and how they differ from each other each, it should be pretty simple to determine which will be the best fit for your business.

Contact us at Trihawk Capital if you have any questions or are looking for more support with other lending options.